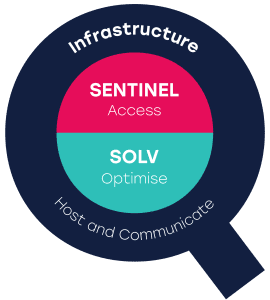

The Quorum platform is a suite of market-proven applications and interfaces designed to provide the ultimate solution for the management of electricity generation and storage assets. Modular design means individual components can be deployed to match your needs as they evolve. As a result, you only pay for the features and functions you need.

Favoured by over half of the businesses active in the BM, SENTINEL is the benchmark for performance and reliability.

Show More

Sentinel EDT ensures that your physical (PN, MEL/MIL) and commercial (Bid/Offer pricing) data are structured correctly, submitted, acknowledged and accepted by NGESO reliably and consistently ahead of Gate Closure. Through integration with SOLV Scheduler, it facilitates automation of these key Trading Point functions.

Sentinel EDL captures and processes instructions from NGESO based on balancing actions required to maintain system stability and match demand. Configurable automation ensures that you never miss an instruction and integration with Sentinel Dashboard optimises the management and redeclaration of your availability (MEL/MIL) and all other dynamic parameters.

The Sentinel OM Gateway provides a Wider Access Operational Metering solution for all BMUs up to 100MW. Designed to integrate with the rest of the Sentinel and SOLV software suite, the OM Gateway supports the submission of Operational Metering and Ancillary Services Performance and Availability files.

Sentinel EAC provides you with complete control and full visibility when participating in NGESO day-ahead auctions. The interface streamlines key auction processes, such as bid creation, validation, submission, and the recording of auction results. This is achieved using our UI and API-enabled web service that eliminates the need for you to interact directly with NGESO’s GraphQL API.

Regardless of the role you wish to take in the market, we can support CVA Qualification by testing and enabling electronic data flows associated with CDCA, CRA, ECVA, SAA and SVAA.

As a VLP or AMVLP, you are required to submit Delivered Volume data for your Secondary BMUs. Sentinel enables you to manage P0282 submissions and their associated feedback flows by providing a reliable interface to the SVAA.

As a trading party, you may need to make ECVN and MVRN submissions. Sentinel supports both, ensuring that your trading position is recorded accurately to mitigate potentially costly imbalance risk. This interface captures Elexon reports utilised by SOLV ETRMi to monitor, report and reconcile your contract position.

Elexon publishes settlement data flows throughout a 14-month settlement cycle. Sentinel consumes thisdata and maintains a persistent record of all SAA settlement flows. This interface captures critical data utilised by SOLV Settlements to synthesise and reconcile your settlement position.

The Sentinel dashboard enables you to monitor the status and behaviour of many assets on a single screen. Dynamic KPIs ensure you have total visibility, while interactive charts enable you to track changing conditions and upcoming events. Full integration with Sentinel EDL provides access to the tools you need to manage availability and dynamic data submissions all in one place, while configurable alerts and alarms ensure that you never miss an important event.

Sentinel PK builds on the functions of the dashboard to provide an enhanced set of tools designed around the needs of control room operators in large-scale power plants, including CCGT and Nuclear. The additional functions include ramp and dynamic data libraries that speed up and ensure the quality of submissions to NGESO as plant state varies.

Show Less

SOLV sharpens your focus on capturing value and your response to fast-moving market conditions.

Show More

Trader can operate in a variety of modes, consuming trading parameters calculated in third-party systems or utilising market and operational data to calculate operating costs, prices and availability curves using configurable algorithms. These inputs inform trading actions both day ahead and intra-day.

Trader enables the efficient preparation of auction submissions for Nordpool auctions, allowing you to focus on tuning prices to maximise the value captured in this important market. By reducing the bidding overhead, SOLV Trader creates the opportunity for you to participate in more auctions without adding trading capacity. Built-in validation ensures the accuracy and integrity of your bids, which are stored to support the audit of your auction activity. SOLV Trader consumes auction results, using them in the calculation of your day-ahead dispatch position.

Continuous interaction with the market via the M7 API ensures a reliable view of all trading activity on EPEX Spot. By comparing the public order book to your own orders, SOLV Trader identifies which of your assets are in the money, suppressing market noise to highlight orders that represent opportunities to capture value. The UI presents a dynamic, instantaneous view of the revenue and margin available, supporting better trading decisions to enhance performance.

Consumes data from your ETRM, either as individual trades or a net position per counterparty. It also utilises the Sentinel Elexon Interface to capture key Elexon reports, including the ECV-I022 Forward Contract Report (AKA 7-day report) and the ECV-I028 Acceptance Feedback Report. Having constructed views of both your internally held contract position and that notified to Elexon by you and your counterparties, SOLV ETRMi performs a reconciliation enabling it to identify and report imbalances that require your attention.

SOLV Settlements captures CDCA and SAA data flows via the Sentinel Elexon Interface. It uses this data to emulate the settlement calculations carried out by Elexon to provide you with early visibility of your settlement position at the end of each settlement day, four working days ahead of the Interim Information (II) run provided by Elexon. This provides an invaluable estimate of BM cash flow and flags potential credit cover issues.

SOLV Settlements equips you with dependable information, so you are well-positioned to investigate and resolve potentially costly variances. SOLV Settlements enables you to track and reconcile variances for each successive settlement run from II to Dispute Final (DF) to ensure that these are addressed before your final position is confirmed. The system also captures of Ancillary Services settlement data (for the Mandatory Frequency Response and Reactive Power services) published by NGESO, providing a comprehensive view of your balancing services settlement position.

SOLV Scheduler supports the management of dispatchable generation, battery storage and renewables providing a single source of the truth as the basis for scheduling your assets. This application uses a range of inputs to ensure that your contractual and regulatory commitments can be met while ensuring that the physical dynamics of your assets are not breached.

By applying rules that interpret the relationship between your PN and availability, Scheduler automatically assigns Bid Offer prices, varying them automatically to reflect changing operating conditions. Integration with Sentinel EDT ensures that optimised BM Trading Point submissions get to NGESO quickly and reliably.

We have codified the rules published by NGESO for BESS active in the BM, embedding them in SOLV Scheduler to automate MEL/MIL availability submissions that must follow the receipt of BOAs. By forecasting state of charge, Scheduler can also identify any potential PN breach. When this risk is detected, the system quantifies the issue and pushes a notification to the user recommending remedial actions to restore PN Integrity.

SOLV Scheduler can actively monitor the live performance metrics of your battery to accurately determine and predict the battery’s output capacity adjusted by efficiency for the upcoming 15-minute interval. Following the acquisition of a BOAI, the module updates the MEL and MIL declarations to reflect this commitment, adhering to the latest guidelines set by NGESO. Moreover, the module is equipped to factor in any potential outages, adjusting the MEL and MIL values appropriately to maintain operational efficiency and compliance with NGESO standards.

Combines technical availability forecasting with REMIT reporting, centralising the recording of planned availability changes, and capturing actual variances through integration with Sentinel EDL. The THOR rule engine interprets availability data and determines whether changes are reportable. As reportable changes are detected, the system formulates REMIT events and publishes them instantaneously ensuring compliance with transparency regulations and enabling trading can continue uninterrupted.

Show Less

We would love to tell you more about what we can do for you and your business.

Why not get in touch?